Employer Obligated To Pay Damages For Delay In Payment Of Epf Contribution Sc

No Penalty On Employers For Delay In Provident Fund Contributions Decides Epfo The Financial Express

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

Tds On Rent 194ib And 194i Flow Chart Flow Chart Rent Individuality

Interest On Epf Contribution Above Rs 2 5 Lakh To Be Taxable What It Means For You Businesstoday

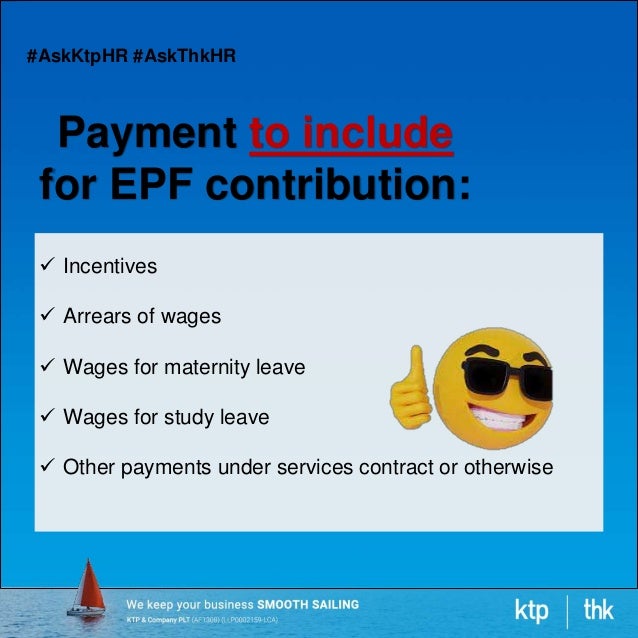

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Epfo Relief For 650 000 Employers No Penalty For Late Epf Deposits Business Standard News

Check Epf Balance In 4 Easy Steps Online Infographic Balance Sms

How To Calculate Provident Fund Online Calculator Government Employment

If Employer And Employee Agree There S No Bar In Epf Enrolment Mint

How To Calculate Epf How Pf Is Calculated In Excel Hr Tutorials India Epf Calculation Youtube

What Is Epf Deduction Percentage Quora

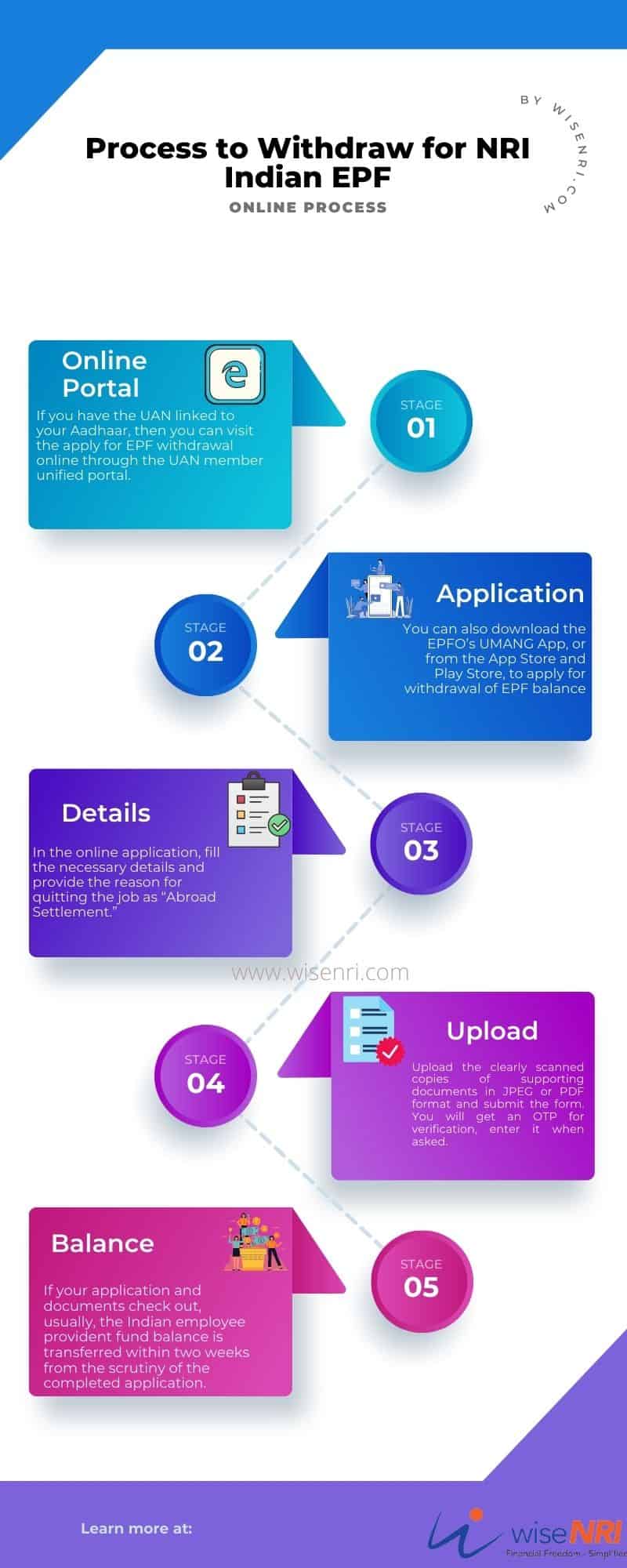

What Should Budding Nris Do With Their Indian Epf Accounts

Epf Member Passbook For Tax Calculation Passbook Flow Chart Hobbies To Try

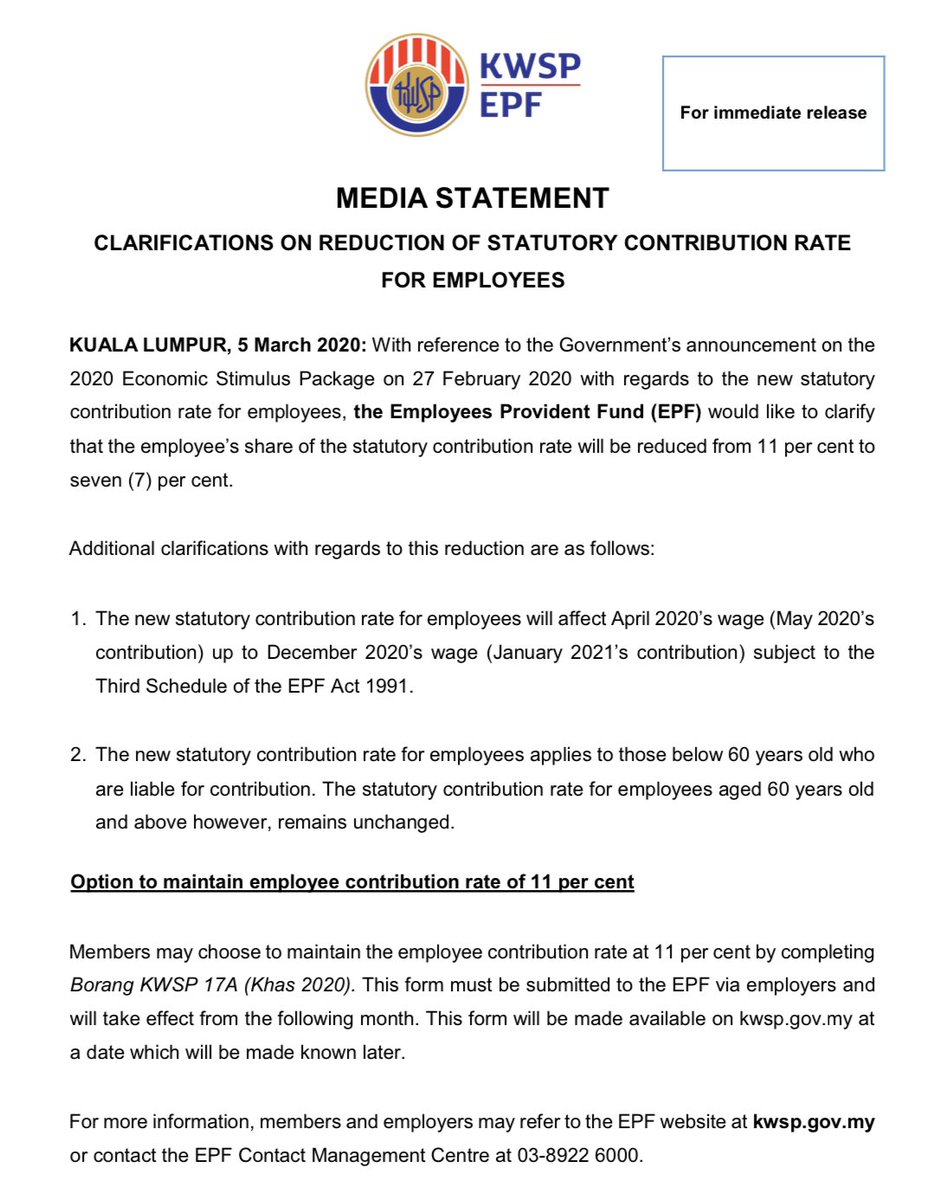

Ibrahim Sani On Twitter For Those Of Us Who Are Contributing To Epf Please Make Sure You Ask Yourself If You Want Your Forced Contribution To Be Reduced To 7 Default Setting

Epf Rate Falls To 8 1 Lowest In 43 Years Investors Can Look At These Investment Options

Ibrahim Sani On Twitter For Those Of Us Who Are Contributing To Epf Please Make Sure You Ask Yourself If You Want Your Forced Contribution To Be Reduced To 7 Default Setting

A Complete Guide On Process For Epf Withdrawal Online Claim Ebizfiling